This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Far East, MTR Launch $ Bonds; Deutsche, Aviva, RBC, Swiss Re and Others Price Bonds

March 25, 2025

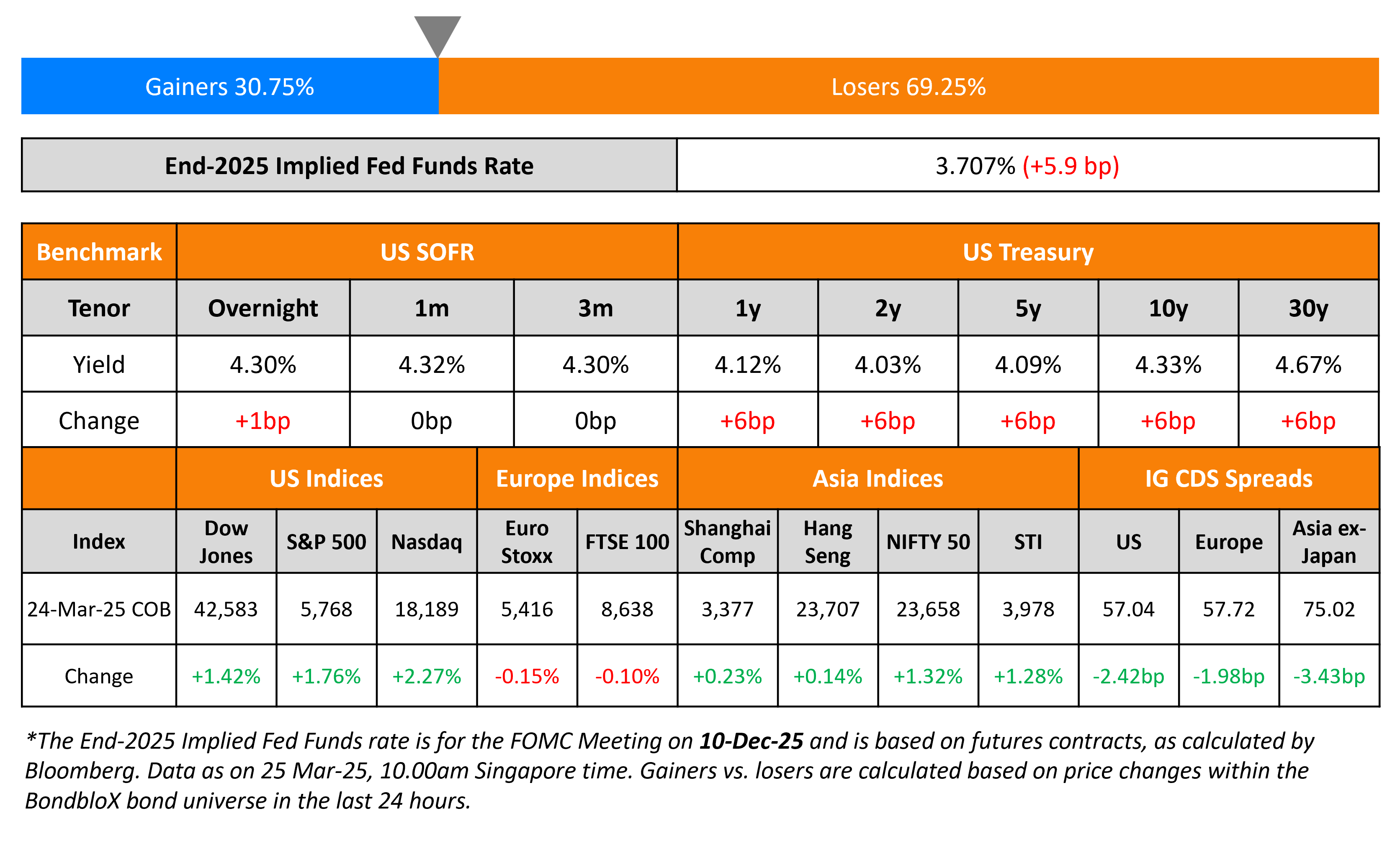

US Treasury yields moved higher by 6bp across the curve, with risk sentiment improving in global markets. Atlanta Fed President Raphael Bostic said that he expects only one Fed rate cut this year, noting that inflation would likely be “bumpy” and not move in a straight path towards the 2% goal. Separately, US President Donald Trump said that he may give several countries breaks on his announced reciprocal tariffs that are set to begin on April 2. The preliminary S&P US Manufacturing PMI number in March fell to 49.8 vs. expectations of 51.7 and the prior month’s 52.7 print. The Services PMI number came-in at 54.3, higher than expectations and the prior month’s 51.0 print.

US equity markets moved higher, with the S&P and Nasdaq up by 1.8% and 2.3% respectively. Looking at credit markets, US IG and HY CDS spreads tightened 2.4bp and 13bp respectively. European equity markets ended marginally lower. The iTraxx Main and Crossover CDS spreads tightened by 2bp and 12bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 3.4bp.

New Bond Issues

-

Bausch Health $4bn 7NC3 at 10%

-

Far East Horizon $ 3.5Y at T+255bp area

-

MTR $ 5Y/10Y/30Y at T+75/85/100bp area

-

LG Energy $ 3Y/5Y/10Y Green at T+165/175/205 bp area

-

Jollibee $ 5Y at T+160bp area

Deutsche Bank raised €1.5bn via a PerpNC6 AT1 bond at a yield of 7.125%, 62.5bp inside initial guidance of 7.75% area. The subordinated bond is rated Ba2/BB. If not called by 30 April 2031, the coupon will reset then and every five years to the 5Y Mid-Swap plus 460bp. A trigger event will occur if at any time, the consolidated CET1 ratio falls below 5.125%. The new AT1 bond was priced at a new issue premium of 28.5bp over its existing 7.375% Perp (callable from 30 October 2031).

Aviva raised £500mn via a PerpNC8 RT1 bond at a yield of 7.75%, ~68.75bp inside initial guidance of 8.375-8.5% area. The subordinated bond is rated Baa2/BBB+ (Moody’s/Fitch). If not called by 31 March 2033, the coupon will reset then and every five years at the UKT+319.4bp. There is no coupon step-up. Net proceeds will be used to fund general business and commercial activities, including refinancing existing securities.

RBC raised $3bn via a four-part deal.

The senior unsecured bonds are unrated. Proceeds will be used for general corporate purposes.

Swiss Re raised $750mn via a 21NC20 Tier 2 bond at a yield of 6.191%, 25bp inside initial guidance of T+175bp area. The subordinated bond is rated A3/BBB+. Proceeds will be used for general corporate purposes.

Hyundai Capital raised $5bn via a five-trancher.

The senior unsecured bonds are rated A3/A-/A-. Proceeds will be used for general corporate purposes.

T-Mobile raised $3.5bn via a three-trancher. It raised:

- $1.25bn via a 7Y bond at a yield of 5.146%, 27bp inside initial guidance of T+120bp area

- $1bn via a 10Y bond at a yield of 5.315%, 27bp inside initial guidance of T+125bp area

- $1.25bn via a long 30Y bond at a yield of 5.9%, 27bp inside initial guidance of T+150bp area

The senior unsecured bonds are rated Baa2/BBB/BBB+. Proceeds will be used for general corporate purposes, including share repurchases and for any dividends declared.

KNOC raised $1bn via a three-trancher. It raised:

- $300mn via a 3Y bond at a yield of 4.66%, 30bp inside initial guidance of T+95bp area

- $400mn via a 3Y FRN at SOFR+77bp vs. initial guidance of SOFR equivalent area

- $300mn via a 5Y bond at a yield of 4.793%, 62.5bp inside initial guidance of T+105bp area

The senior unsecured bonds are rated Aa2/AA. Proceeds will be used for general corporate purposes and will not be used for any activities relating to construction or development of oil sand projects.

New Bonds Pipeline

- Shinhan Bank hires for $ bond

- Morocco hires for € 4Y/10Y bond

- Petronas hires for $ 5Y Long/10Y/30Y bond

Rating Changes

-

Moody’s Ratings upgrades Merck & Co.’s rating to Aa3; outlook is stable

-

Italy-Based Nexi SpA Upgraded To ‘BBB-‘ On Positive Deleveraging Trajectory; Outlook Stable

-

Antero Midstream Partners LP’s Stand-Alone Credit Profile Revised Up To ‘bb+’ And ‘BB+’ Ratings Affirmed On Sustained Deleveraging

Term of the Day: Restricted Tier 1 (RT1)

Restricted Tier 1 (RT1) bonds are junior subordinated securities issued by insurers that qualify as capital under Europe’s insurance regulation (known as Solvency II). To qualify as Tier 1 capital, the bonds must be perpetual, no step-up in coupon and a contractual trigger to principal write-down or equity conversion. According to the Solvency II directive, RT1s will automatically convert into equity or be written down upon three events:

– Breach of the Solvency Capital Requirement (SCR), which defines the capital required to ensure that the insurance company can meet its obligations over the next 12 months, for more than three months

– Drop of solvency ratio below 75% of the SCR

– Breach of the Minimum Capital Requirement (MCR), which is the threshold below which the national regulator would intervene

Talking Heads

On US government could face default risk as soon as July

Shai Akabas, BPC

“Lawmakers cannot afford to delay action on the debt limit. Addressing debt limit well ahead of the X Date should rise to the top of the priority list.”

On Brazil Recession Fears Proving Overblown – BE Modeling

“While recession risks are relatively low, the economy is losing steam. We think rates hikes are working as expected, with some lagged effects yet to hit… ensuing hit to financial conditions (from boosting fiscal stimulus) would actually raise the risk of recession”

On Credit ‘Reckoning’ as Complacency Wanes – Victor Khosla, Strategic Value Partners LLC

Credit complacency isn’t over yet because spreads are still “incredibly” tight… “There’s a moment in time when real estate gets interesting”… money managers can earn 8% from junk bonds.

Top Gainers and Losers- 25-March-25*

Go back to Latest bond Market News

Related Posts: